Forgery definition

A forgery definition is any writing prepared with the intent to deceive or defraud. Thus, forgery meaning occurs when an individual, with intent to defraud, makes or alters a document apparently capable of defrauding another.

A document is not a forgery crime just because it contains a false representation. To constitute a forgery definition, the writing as a whole must have apparent legal significance. In addition, forgery crime occurs not only when an entire writing or instrument is created, but also when there is any material alteration that affects the legal significance of the document or whenever a signature on a writing is fraudulently procured from a person who does not know what he is signing. Furthermore, the forgery definition is committed even if no one is actually defrauded.

Forged Maker Schemes in forgery definition

Forgery definition can include not only the signing of another person’s name to a document such as a cheque (check forgery) with a fraudulent intent, but the forgery crime is also the fraudulent alteration of a genuine instrument.

This forgery definition is so broad that it would encompass all cheque tampering schemes. For the purposes of this post, the forgery definition has been narrowed to fit the fraud examiner’s needs. To properly distinguish the various methods used by individuals to tamper with cheques, the concept of “forgery crime” will be limited to those cases in which an individual signs another person’s name on a cheque.

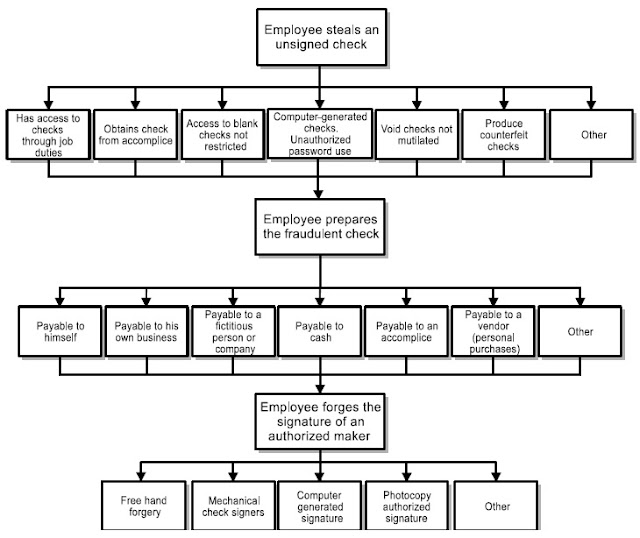

The person who signs a cheque in forgery definition is known as the “maker” of the cheque. A forged maker scheme can thus be defined as a cheque tampering scheme in which an employee misappropriates a cheque and fraudulently affixes the signature of an authorised maker thereon. Frauds that involve other types of cheque tampering, such as the alteration of the payee or the changing of the dollar amount, are classified separately.

To forge a cheque, an employee must have access to a blank cheque, be able to produce a convincing forgery meaning of an authorised signature, and be able to conceal his crime.

Concealment is a universal problem in cheque tampering schemes; the methods used are basically the same whether one is dealing with a forged maker scheme, an intercepted cheque scheme, or an authorised maker scheme.

This forgery definition is so broad that it would encompass all cheque tampering schemes. For the purposes of this post, the forgery definition has been narrowed to fit the fraud examiner’s needs. To properly distinguish the various methods used by individuals to tamper with cheques, the concept of “forgery crime” will be limited to those cases in which an individual signs another person’s name on a cheque.

The person who signs a cheque in forgery definition is known as the “maker” of the cheque. A forged maker scheme can thus be defined as a cheque tampering scheme in which an employee misappropriates a cheque and fraudulently affixes the signature of an authorised maker thereon. Frauds that involve other types of cheque tampering, such as the alteration of the payee or the changing of the dollar amount, are classified separately.

To forge a cheque, an employee must have access to a blank cheque, be able to produce a convincing forgery meaning of an authorised signature, and be able to conceal his crime.

Concealment is a universal problem in cheque tampering schemes; the methods used are basically the same whether one is dealing with a forged maker scheme, an intercepted cheque scheme, or an authorised maker scheme.

Obtaining the Cheque for the forgery definition

EMPLOYEES WITH ACCESS TO COMPANY CHEQUES

One cannot forge a company cheque unless one first possesses a company cheque. Most schemes of forgery meaning are committed by accounts payable clerks, office managers, bookkeepers, or other employees whose duties typically include the preparation of company cheques. These are people who have access to the company chequebook on a regular basis and are therefore in the best position to steal blank cheques.

EMPLOYEES LACKING ACCESS TO COMPANY CHEQUES

If perpetrators do not have access to the company chequebook through their work duties, they will have to find other means of forgery definition and misappropriating a cheque. The method by which a person steals a cheque depends largely on how the chequebook is handled within a particular company. In some circumstances, the chequebook is poorly guarded and left in unattended areas where anyone can get to it. In other companies, the cheque stock might be kept in a restricted area, but the perpetrator might have obtained a key or combination to this area, or might know where an employee with access to the cheques keeps his own copy of the key or combination. An accomplice might provide blank cheques for the fraudster in return for a portion of the stolen funds. Perhaps a secretary sees a blank cheque left on a manager’s desk or a custodian comes across the cheque stock in an unlocked desk drawer.

In some companies, cheques are computer-generated. When this is the case, an employee who knows the password for preparing and issuing cheques can usually obtain as many unsigned cheques as he desires and commit a forgery definition. There are an unlimited number of ways to steal a cheque, each dependent on the way in which a particular company guards its blank cheques. In some instances, employees go as far as to produce counterfeit cheques.

In some companies, cheques are computer-generated. When this is the case, an employee who knows the password for preparing and issuing cheques can usually obtain as many unsigned cheques as he desires and commit a forgery definition. There are an unlimited number of ways to steal a cheque, each dependent on the way in which a particular company guards its blank cheques. In some instances, employees go as far as to produce counterfeit cheques.

To Whom Is the Cheque Made Payable in forgery definition?

TO THE PERPETRATOR

Once a blank cheque has been obtained, the perpetrator must decide to whom it should be made payable. In most instances forged cheques are made payable to the perpetrator himself so that they can be easily converted to the forgery definition. Cancelled cheques that are payable to an employee should be closely scrutinised for the possibility of fraud and forgery meaning.

If the perpetrator owns his own business or has established a shell company, he will usually write fraudulent cheques to these entities rather than himself. These cheques are not as obviously fraudulent on their faces as cheques made payable to an employee. At the same time, these cheques are easy to convert because the perpetrator owns the entity to which the cheques are payable.

If the perpetrator owns his own business or has established a shell company, he will usually write fraudulent cheques to these entities rather than himself. These cheques are not as obviously fraudulent on their faces as cheques made payable to an employee. At the same time, these cheques are easy to convert because the perpetrator owns the entity to which the cheques are payable.

TO AN ACCOMPLICE

If a fraudster is working with an accomplice, he can make the forged cheque payable to that person. The accomplice then cashes the cheque and splits the money with the employee fraudster. Because the cheque is payable to the accomplice in his true identity, it is easily Converted and the forgery definition is done. An additional benefit to using an accomplice is that a cancelled cheque payable to a third-party accomplice is not as likely to raise suspicion as a cancelled cheque to an employee. The obvious drawback to using an accomplice in a scheme is that the employee fraudster usually has to share the proceeds.

TO “CASH”

The perpetrator might also write cheques payable to “cash” to avoid listing himself as the payee. Cheques made payable to cash, however, must still be endorsed. The perpetrator will have to sign his own name or forge the name of another to convert the cheque. Cheques payable to “cash” are usually viewed more sceptically than cheques payable to persons or businesses. Some institutions might refuse to cash cheques made payable to “cash” to avoid forgery definition.

TO VENDORS

Not all fraudsters forge company cheques to obtain cash. Some employees use forged maker schemes to purchase goods or services for their own benefit. These fraudulent cheques are made payable to third-party vendors who are uninvolved in the fraud. For instance, the forgery definition is done if an employee might forge a company cheque to buy a computer for his home. The computer vendor is not involved in the fraud at all. Furthermore, if the victim organisation regularly does business with this vendor, the person who reconciles the company’s accounts might assume that the cheque was used for a legitimate business expense.

Forgery definition by Forging the Signature

After the employee has obtained and prepared a blank cheque, he must forge an authorised signature to convert the cheque. The most obvious method, and the one that comes to mind when one thinks of the word forgery definition, is to simply take pen in hand and sign the name of an authorised maker.

FREE-HAND forgery definition

The difficulty a fraudster encounters when physically signing the authorised maker’s name is in creating a reasonable approximation of the true signature. If the forgery definition appears authentic, the perpetrator will probably have no problem cashing the cheque. In truth, the forged signature might not have to be particularly accurate. Many fraudsters cash forged cheques at liquor stores, grocery stores, or other institutions that are known to be less than diligent in verifying signatures and identification. Nevertheless, a poorly forgery definition by forged signature is a clear red flag of fraud. The maker’s signature on cancelled cheques should be reviewed for forgery meaning during the reconciliation process.

PHOTOCOPIED forgery definition

To guarantee an accurate forgery definition, some employees make photocopies of legitimate signatures. The signature of an authorised signer is copied from some document (such as a business letter) onto a transparency and then the transparency is laid over a blank cheque so that the signature copies onto the maker line of the cheque. The result is a cheque with a perfect signature of an authorised maker.

Forgery definition by AUTOMATIC CHEQUE and SIGNING MECHANISMS

Companies that issue a large number of cheques sometimes use automatic cheque-signing mechanisms in lieu of signing each cheque by hand. Automated signatures are produced with manual instruments, such as signature stamps, or they are printed by computer. Obviously, a fraudster who gains access to an automatic cheque-signing mechanism will have no trouble forging the signatures of authorised makers. Even the most rudimentary control procedures should severely limit access to these mechanisms.

The same principle applies to computerised signatures. Access to the password or programme that prints signed cheques should be restricted, specifically excluding those who prepare cheques and those who reconcile the bank statement.

The same principle applies to computerised signatures. Access to the password or programme that prints signed cheques should be restricted, specifically excluding those who prepare cheques and those who reconcile the bank statement.

Converting the Cheque in forgery definition

To convert the forged cheque, the perpetrator must endorse it. The endorsement is typically made in the name of the payee on the cheque. Since identification is typically required when one seeks to convert a cheque, the perpetrator usually needs fake identification if he forges cheques to real or fictitious third persons. As discussed earlier, cheques payable to “cash” require the endorsement of the person converting them. Without a fake ID the perpetrator will likely have to endorse these cheques in his own name. An employee’s endorsement on a cancelled cheque is obviously a red flag.

Endorsement Schemes in forgery definition

Forged endorsements are those cheque tampering schemes in which an employee intercepts a company cheque intended to pay a third party and converts the cheque by endorsing it in the third party’s name. In some cases the employee also signs his own name as a second endorser.

A fraudster’s main dilemma in a forged endorsement scheme (and in all intercepted cheque schemes, for that matter) is gaining access to a cheque after it has been signed. The fraudster must either steal the cheque between the point where it is signed and the point where it is delivered, or he must re-route the cheque, causing it to be delivered to a location where he can retrieve it. The manner used to steal a cheque depends largely upon the way the company handles outgoing disbursements. Anyone who is allowed to handle signed cheques might be in a good position to intercept them.

Forgery definition by Intercepting Cheques Before Delivery

EMPLOYEES INVOLVED IN DELIVERY OF CHEQUES

Obviously, the employees in the best position to intercept signed cheques are those whose duties include the handling and delivery of signed cheques. The most obvious example is a mailroom employee who opens outgoing mail containing signed cheques and steals the cheques. Other personnel who have access to outgoing cheques might include accounts payable employees, payroll clerks, and secretaries.

POOR CONTROL OF SIGNED CHEQUES

Unfortunately, employees are often able to intercept signed cheques because of poor internal controls. For instance, many employees simply find signed cheques left unattended in the work areas of the individuals who signed them or the people charged with their delivery. In these cases it is easy for the perpetrator to steal the cheque. Another common breakdown occurs when the person who prepares a cheque is also involved in the delivery of that cheque once it has been signed.

In addition to the preceding example, secretaries or clerks who prepare cheques for their bosses to sign are often responsible for mailing those cheques. It is very simple for those employees to make out a fraudulent cheque and obtain a signature, knowing that the boss will give the signed cheque right back to them. This scheme is indicative of the key problem with occupational fraud: trust. For an office to run efficiently, high-level employees must be able to rely on their subordinates. Yet this reliance is precisely what puts subordinates in a position to defraud their employer.

In addition to the preceding example, secretaries or clerks who prepare cheques for their bosses to sign are often responsible for mailing those cheques. It is very simple for those employees to make out a fraudulent cheque and obtain a signature, knowing that the boss will give the signed cheque right back to them. This scheme is indicative of the key problem with occupational fraud: trust. For an office to run efficiently, high-level employees must be able to rely on their subordinates. Yet this reliance is precisely what puts subordinates in a position to defraud their employer.

forgery definition by Theft of Returned Cheques

Cheques that have been mailed and are later returned to the victim for some reason, such as an incorrect address, are often targeted for theft by fraudsters. Employees with access to incoming mail are able to intercept these returned cheques and convert them by forging the intended payee’s endorsement.

Forgery definition by Re-Routing the Delivery of Cheques

Employees might also misappropriate signed cheques by altering the addresses to which those cheques are mailed. These perpetrators usually replace the payee’s legitimate address with an address where the employee can retrieve the cheque, such as the employee’s home or a PO Box the employee controls. In other instances, the perpetrator might purposely misaddress a cheque so that it will be returned as undeliverable. The employee steals the cheque after it is returned to the victim organisation.

Obviously, proper separation of duties should preclude anyone who prepares disbursements from being involved in their delivery. Nevertheless, the person who prepares a cheque is often allowed to address and mail it as well. In some instances where proper controls are in place, employees are still able to cause the misdelivery of cheques.

Obviously, proper separation of duties should preclude anyone who prepares disbursements from being involved in their delivery. Nevertheless, the person who prepares a cheque is often allowed to address and mail it as well. In some instances where proper controls are in place, employees are still able to cause the misdelivery of cheques.

Forgery definition by Converting the Stolen Cheque

Once a cheque has been intercepted, the perpetrator can cash it by forging the payee's signature, hence the term forged endorsement scheme. Depending on where he tries to cash the cheque, the perpetrator may or may not need fake identification at this stage. If a perpetrator is required to produce identification to cash his stolen cheque, and if he does not have a fake ID in the payee’s name, he might use a dual endorsement to cash or deposit the cheque. In other words, the perpetrator forges the payee’s signature as though the payee had transferred the cheque to him, and then the perpetrator endorses the cheque in his own name and converts it. When the bank statement is reconciled, dual endorsements on cheques should always raise suspicions, particularly when the second signer is a company employee.